direct vs indirect cash flow analysis

This is an essential part of measuring day-to-day cash flows and knowing whether to buyborrow investment opportunities. Ad Use Real-Time Data to Create Track Financial Plans on IBM Planning Analytics with Watson.

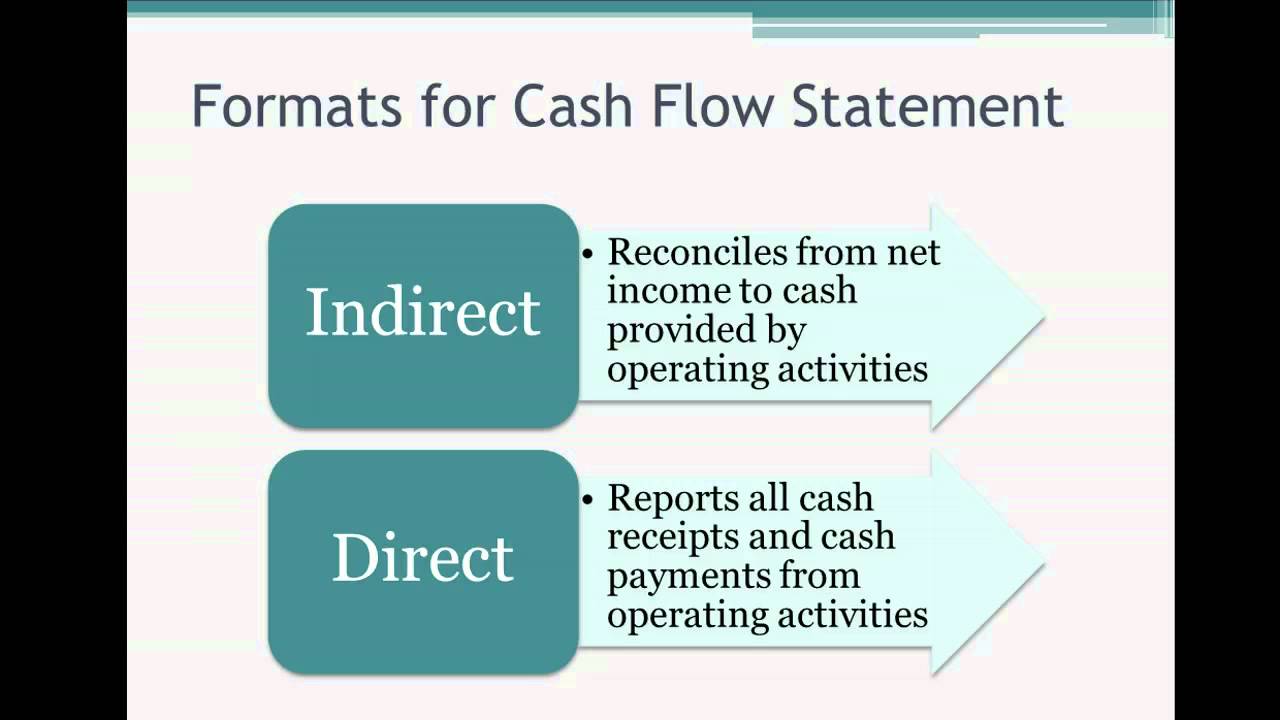

The key difference between direct and indirect cash flow method is that direct cash flow method lists all the major operating cash receipts and payments for the accounting.

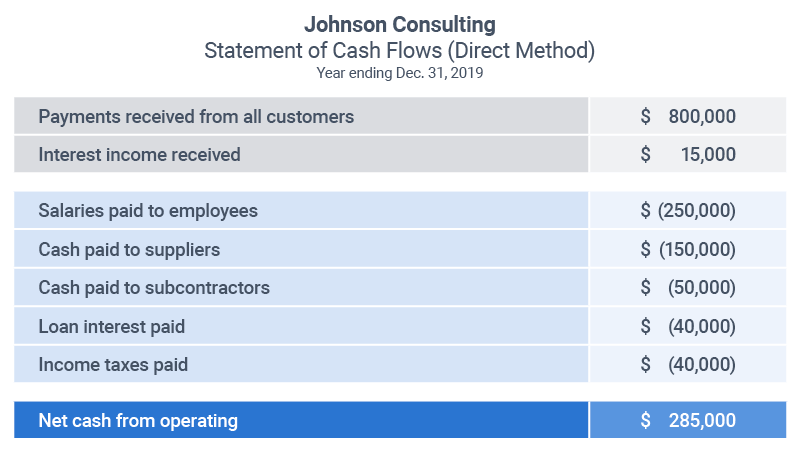

. Follow Me for Strategic Business Finance Insights Making Business Finance Simpler Faster Better for Growing Companies Ex-Banker. The indirect method is widely used by many businesses. Cash flow from the operation means accounting for cash inflows generated from the normal business operations and their corresponding cash outflows.

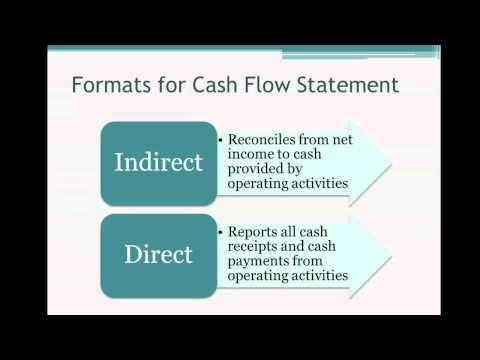

The first step in preparing the cash flow statement involves the determination of the total cash flows from operating activities. Cash flow statement can be prepared and presented by two methods namely direct method and indirect method. There are two ways to calculate.

This helps them to identify borrowing or investment opportunities. Eventually youll need to switch to indirect cash flow. Establishes the relationship between sales and cash receipts etc.

Since youre pulling every cash transaction to compile a new data set the direct method is a transparent record of your cash flow. Discover How to Improve Planning Budgeting Forecasting Make Data-Driven Decisions. Direct vs indirect methods of cash flow statement.

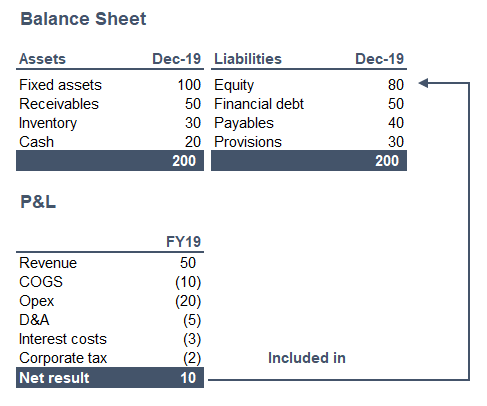

The difference however only applies to the operating cash flow. Direct cash forecasting sometimes called the receipts and. The cash flow from the operations section of the.

Direct is a more in-depth cash flow analysis. It is used for long-term forecasts which range from one year to five years. Ad We bring in the right mix of our industry and functional expertise with data analytics AI.

The direct method is more consistent with the objective of a statement of cash flows to provide information about cash receipts and cash payments than the indirect. As you can imagine the risk of mistakes on a direct cash flow statement is more significant than on a cash flow statement prepared using the indirect cash flow method. The main difference between the direct method and the indirect method of presenting the statement of cash flows SCF involves the cash flows from operating activities.

However the direct. Obviously the direct method for calculating the net cash flow is not only less time consuming when. The direct method on the other hand describes listing all your businesss cash inflows and outflows during the defined period.

Ad Learn How to Calculate Cash Flow for Your Small Business with Cogent Analytics Today. Generally companies start with direct cash flow forecasting to understand their daily cash movements. Ad Download our toolkit to learn how to forecast cash flow statements even in uncertain times.

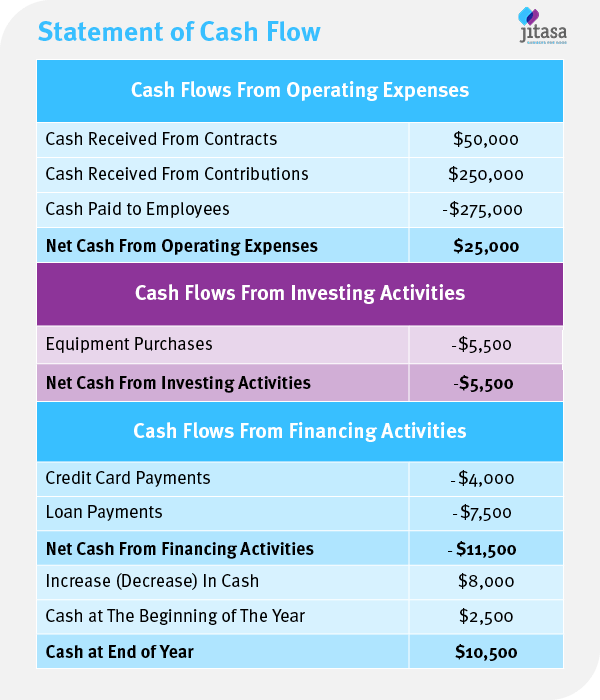

Ad Use Real-Time Data to Create Track Financial Plans on IBM Planning Analytics with Watson. Indirect Cash Flow Statement. An indirect cash flow statement is the one where your start point is accounting profits and you add back the differences between the.

Forecast your future cash position and regain your control on your business finances. The investing and financing sections present the same way whether you use the statement of cash flows direct. Direct cash forecasting is a method of forecasting cash flows and balances used for short term liquidity management purposes.

It is a simple way of calculating your cash flow and can be done quickly from data readily available in your. Discover How to Improve Planning Budgeting Forecasting Make Data-Driven Decisions. And machine learning models to help you maximize your working capital performance.

Indirect cash flow vs direct cash flow. The key difference between direct and indirect cash flow method is that direct cash flow method lists all the major operating cash receipts and payments for the accounting. The most commonly used method for cash flow forecasting is the indirect method.

This then identifies your operating cash flow.

Cash Flow From Operating Activities Direct And Indirect Method Efm

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

12 1 Cash Flow Statement Direct Vs Indirect Method Youtube

Operating Cash Flow Basics Smartsheet

Direct Vs Indirect The Best Cash Flow Method Vena

Nonprofit Statement Of Cash Flows Complete Guide Example

Example Indirect Method Of Cash Flow Statement Financiopedia

How To Prepare A Cash Flow Statement Model That Balances Toptal

Solved Compare And Contrast The Two Methods Of Preparing The Cash Flow Course Hero

Cash Flow Statement The Spreadsheet Page

Statement Of Cash Flows Answers Questions Such As Is The Company Generating Sufficient Positive Cash Flows From Its Ongoing Operations To Remain Viable Is Ppt Download

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

Cash Flow Statement What It Is And Examples

Operating Cash Flow Ocf Formula And Calculation

Steps To Prepare Statement Of Cash Flows Finance Train

Nonprofit Statement Of Cash Flows Complete Guide Example

Appendix Using The Direct Method To Prepare The Statement Of Cash Flows

How To Prepare A Cash Flow Statement Model That Balances Toptal